what does a company have to pay for taxes

This commodity has been reviewed by tax expert Erica Gellerman, CPA.

When choosing a business entity for your company, taxes are paramount. The amount of taxes yous'll owe to the government is directly connected to your business entity structure. A express liability visitor (LLC) is a blazon of concern that is registered with the state and provides personal liability protection for owners.

How do LLC taxes work?

An LLC is typically treated as a pass-through entity for federal income tax purposes. This ways that the LLC itself doesn't pay taxes on business income. The members of the LLC pay taxes on their share of the LLC's profits. State or local governments might levy boosted LLC taxes. Members can choose for the LLC to exist taxed as a corporation instead of a pass-through entity.

There are several types of LLC taxes. The federal government, besides as state and local governments, levy these taxes. All LLC members are responsible for paying income tax on whatever income they earn from the LLC too equally self-employment taxes. Depending on what you sell and whether you employ anyone, you lot might also be responsible for paying payroll taxes and sales taxes. To complicate things even more, an LLC can opt to exist taxed equally a different business entity.

In this guide, nosotros'll cover the entire range of LLC taxes, what you lot'll exist responsible for, and options for reducing your tax bill. Understanding your tax burden in advance can help you make smarter financial decisions.

How LLCs pay income taxes

There's a wide range of business taxes that the owners of an LLC might be responsible for. Federal, country, and local income taxes represent the biggest brunt for most business organization owners. The way in which you lot file and pay income taxes depends on whether your LLC has ane owner (a single-member LLC) or multiple owners (a multi-fellow member LLC).

Income taxes for unmarried-fellow member LLCs

By default, the IRS treats a unmarried-member LLC as a disregarded entity for federal income tax purposes. According to Vincent Porter, a certified public accountant (CPA) at MyTexasCPA, "A disregarded entity means that the LLC is non required to file a separate income tax return to report income and expenses. The income and expenses will go directly on the member's tax return."

In other words, every bit the sole possessor of an LLC, you'll study business concern income and expenses on Form 1040, Schedule C, similar to a sole proprietor. If, later on deducting business organisation expenses, the LLC generates a profit for the year, the owner will owe taxes to the IRS in accordance with their personal income tax charge per unit. If the LLC operates at a loss for the yr, the owner tin deduct the business's losses from their personal income.

This process generally works the same way at the state and local level. For example, a unmarried owner of a New York Metropolis LLC will written report business income on their federal and state personal tax returns. The income will exist taxed at the owner'southward federal, state, and local personal income revenue enhancement rate. The fundamental is that y'all'll only exist taxed on income that's attributable to the state or locality. According to Porter, "States will revenue enhancement an LLC relative to the corporeality of sales, payroll, or assets that are owned in that state. In other words, if federal income is $100 and the company has $50 of payroll in New York and $200 of payroll everywhere, New York would tax $25 of the income to the state ($50/$200 10 $100)."

Some states charge a separate LLC tax or fee. California, for example, charges an $800 annual LLC taxation, plus an annual fee that varies based on your LLC's California income. Have these LLC taxes into account when selecting your business structure and making budgeting decisions.

Income taxes for multi-member LLCs

Multi-member LLCs are treated every bit pass-through entities for federal income tax purposes. Similar to the single-member LLC, this ways that the LLC doesn't pay taxes of its own. Instead, each fellow member pays taxes on the business's income in proportion to their buying stake in the LLC. Thus, the LLC tax rate is in accordance with each fellow member's individual income tax bracket.

If, for instance, two members in an LLC have a 50-50 ownership split, each owner will be responsible for paying taxes on half of the business's profits. Each owner can also claim half of the tax deductions and taxation credits that the LLC is eligible for, and write off one-half of the losses. This type of taxation works almost exactly like a partnership.

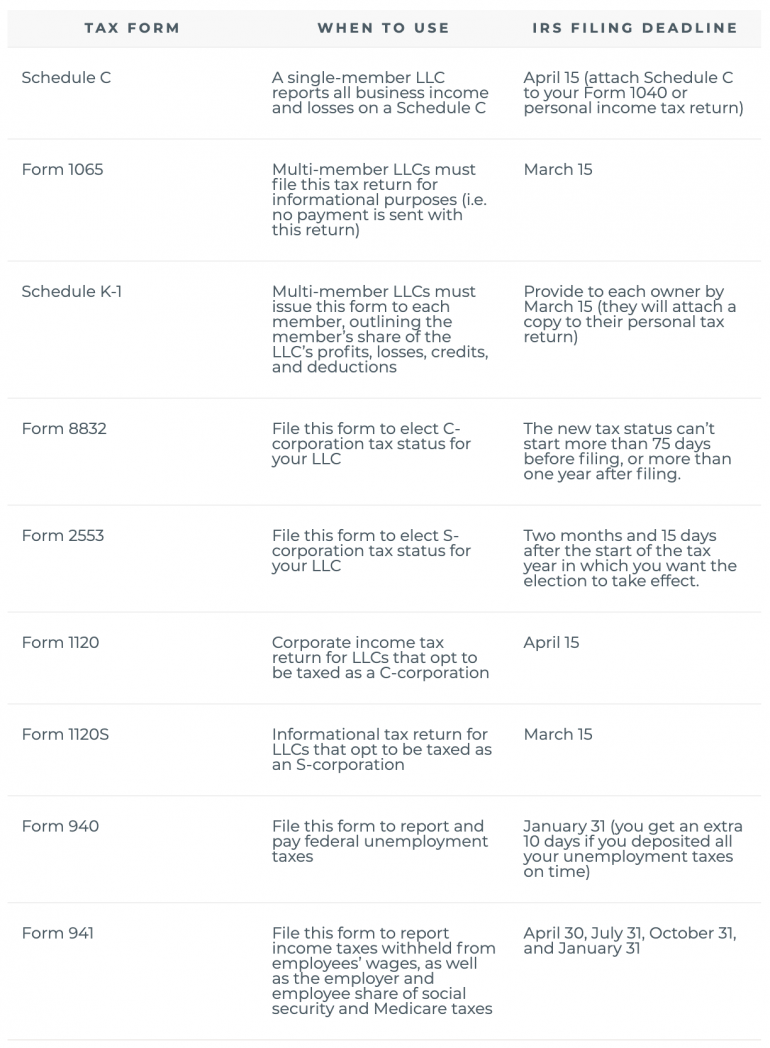

A multi-fellow member LLC has to file certain tax forms with the IRS, including Form 1065, U.S. Render of Partnership Income—an informational return that must be filed annually with the IRS. The LLC must also give each possessor a completed Schedule Chiliad-1 by March xv of each twelvemonth. The Schedule K-1 summarizes each owner'due south share of LLC income, losses, credits, and deductions. Each owner will attach their Schedule One thousand-1 to their personal income tax return that'south filed with the IRS.

Pass-through revenue enhancement continues at the state and local levels. Most states have their ain equivalent of Class 1065 and Schedule K-1. As mentioned above, a few states similar California charge boosted LLC taxes.

Choosing corporate tax status for your LLC

Then far, we've discussed the default income tax rules for LLCs, but things tin get more than complicated. The members of an LLC tin choose for the business organization to be classified as a C-corporation or Due south-corporation for revenue enhancement purposes. The voting procedure and consent required to brand this change volition be reflected in the LLC operating agreement.

Your LLC tin can opt to be taxed as a C-corporation by filing Grade 8832 with the IRS (your state might as well crave additional forms for a change in tax status). If you make this change, your LLC volition be discipline to the 21% federal corporate tax rate. You lot'll demand to file taxes using Form 1120 , U.South. Corporation Income Tax Return. You'll as well pay land and local corporate taxes every bit applicable where your business concern is located.

To opt for Due south-corporation tax status, file Form 2553 with the IRS. An S-corp is taxed like a laissez passer-through entity, similar to an LLC, with some differences in how salary and distributions from the business organisation are taxed. To file taxes for an Due south-corp, submit Form 1120S, U.S. Income Taxation Return for an S-corporation, to the IRS.

Note that choosing corporate tax status won't affect your LLC from a legal standpoint. Legally, your business organisation will continue to operate as an LLC. You should consult with a tax professional to come across if you'd benefit from corporate tax condition. Income in a corporation is taxed differently than an LLC, and a corporation is eligible for more than deductions and credits.

LLC payroll taxes

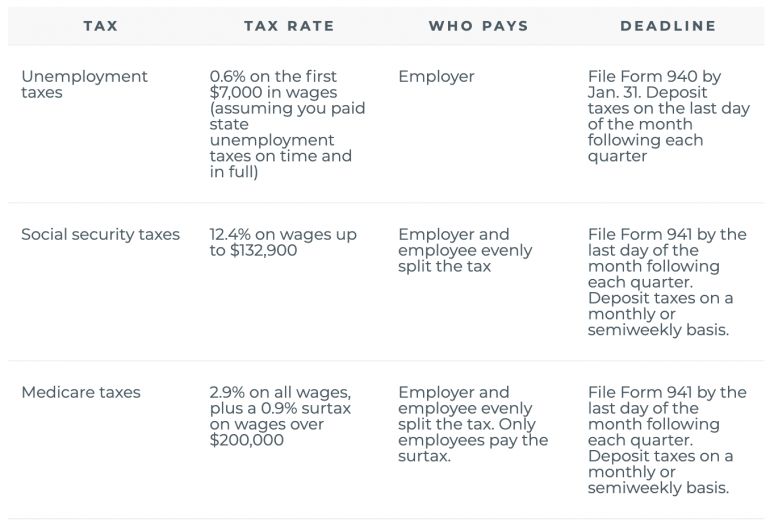

LLCs that have employees take to collect and pay payroll taxes. These taxes include unemployment taxes, social security taxes, and Medicare taxes. Employers pay unemployment taxes to fund unemployment benefit programs. Employers and employees share in the payment of social security and Medicare taxes (collectively called FICA taxes nether the Federal Insurance Contributions Act). Employers have to withhold the employee share of these taxes, along with income taxes, from their employees' paychecks.

Payroll taxes are filed using IRS Class 940 and Grade 941. Form 940 is filed annually and is used to report an employer'south unemployment tax obligations. Form 941 is filed on a quarterly footing. Businesses use this form to study withheld income taxes and the employer and employee's portion of social security and Medicare taxes.

One matter to note is that these taxes aren't paid when y'all file the revenue enhancement forms. The IRS utilizes a pay-as-you-go organization for payroll taxes, so yous'll demand to deposit your payroll taxes throughout the year according to the schedule ready by the IRS. Deposits can be made on the Electronic Federal Tax Payment Organization (EFTPS). Unemployment taxes are deposited quarterly, whereas social security and Medicare taxes are deposited either monthly or semiweekly depending on the amount of your tax liability. The IRS instructions for Form 940 and Form 941 can help you determine your eolith schedule.

For reference, here are the current federal taxation rates for unemployment taxes, social security taxes, and Medicare taxes:

Forth with federal payroll taxes, states and local governments ofttimes charge additional payroll taxes. For payroll taxes that are the employee's responsibleness, you'll have to brand the necessary withholdings and remit payment to the state or locality. You'll pay employer taxes directly to the tax agency.

LLC self-employment taxes

Members of an LLC are not considered employees. However, under the Self Employment Contributions Act (SECA), you lot withal owe social security and Medicare taxes to the IRS. Y'all'll pay these taxes directly to the IRS in the course of self-employment taxes. The total self-employment revenue enhancement is fifteen.3%, and it's broken downwardly into several parts:

-

12.four% social security tax on earnings up to $137,700

-

2.nine% Medicare tax on all earnings

-

0.9% Medicare surtax on earnings over $200,000

Schedule SE volition assistance you calculate your taxation liability and should be attached to your taxation return.

LLC sales taxes

If your LLC sells taxable appurtenances or services, then you lot'll need to collect sales tax from your customers and remit the tax to the state or local tax bureau. Which goods and services are taxable depends on the state and locality where you practise concern. Forty-five states impose sales tax. Alaska does not levy a state sales tax, but several cities in Alaska accuse local sales tax.

The legal test for whether you lot have to collect sales tax has to do with "nexus." Sales tax nexus ways that you have plenty of a connexion with a state or locality that you're obligated to collect and remit sales tax there. The connection could be a physical shop in the area, employing people in the area, or shipping goods into the area. Online businesses could exist responsible for collecting sales taxes in a state simply by virtue of the fact that they send goods there.

About states follow destination-based tax rules, which ways that the sales tax rate is tied to the final commitment location of the production or service. A small number of states follow origin-based tax rules, in which instance the sales tax charge per unit is tied to the location of the business organisation which sold the proficient or service. Contact the departments of acquirement in the areas where you sell to check the rules that apply to your business.

LLC tax forms and LLC tax deadlines

The exact taxation forms y'all'll need to consummate your LLC taxes depend on three things:

-

Whether your LLC is single-member or multi-member

-

Whether you choose default (laissez passer-through) tax condition or corporate tax condition for your LLC

-

Whether your LLC has employees

Here are the commonly used LLC revenue enhancement forms and corresponding deadlines:

Note that if a tax borderline falls on a Saturday, Sunday, or federal vacation , you can file the certificate on the next business organization twenty-four hour period. Also, if you request an extension for tax filing, you'll become an additional six months to file. For example, tax filers who request an extension to file Form 1065 will have until September 15 to do and then. Use Form 4868 to request an extension if you're a single-member LLC taxed as a overlooked entity. In all other cases, use Form 7004 to request an extension on business concern tax filing.

LLC tax tips for business owners

It'due south easy to experience overwhelmed past all the tax responsibilities an LLC might have. Fortunately, in that location are a few ways to lower your taxation brunt and make tax filing easier.

Here are some tips for LLC taxation filing:

-

Take advantage of whatsoever taxation deductions and taxation credits that your LLC is eligible for.

-

Review business tax deadlines in advance, and notation relevant due dates.

-

Hire a certified public accountant or tax professional to help you with tax filing.

-

Talk with your CPA or revenue enhancement professional person well-nigh the potential benefits of electing corporation revenue enhancement status for your LLC.

-

Understand your country and locality's tax requirements.

Porter says that understanding your LLC'south tax setup in the kickoff is important. "Common mistakes are not engaging a CPA that is familiar with the tax rules surrounding LLCs. It's much easier and cheaper in the long run to set up the LLC correctly the first time and make the valid elections for the LLC to be taxed every bit the business organization owner wishes."

The bottom line

As yous now know, there are several types of LLC taxes that you might exist responsible for. With so many obligations to remember, it's important to stay organized then that you file the correct forms and pay your LLC taxes at the correct time. If you need extra time to file your LLC taxes, request an extension so yous don't take to pay any penalties. With taxes taken care of, you'll be able to focus on what matters most—running a stellar small business concern and making your customers happy.

How Much Do You Need?

with Fundera past NerdWallet

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

Source: https://www.nerdwallet.com/article/small-business/small-business-llc-taxes

0 Response to "what does a company have to pay for taxes"

Post a Comment